Rental property basis calculator

But basis can also increase or decrease during the time you own the property. You can use the portfolio basis the individual property basis or both options together if you have more than one property.

The Complexities Of Calculating The Cost Basis Of Your Home Real Estate Tips Things To Sell Complex

It will estimate the tax deductions of individual properties as well as your property portfolio.

. The first is that investors earn regular cash flow usually on a monthly basis in the form of rental payments from tenants. The buy-to-let London yield map is updated daily and provides rental yield data at street level. The key difference between the options is with the.

HECSHELP loan repayment rates. Inheriting a rental property is like getting money for free. Our rental property calculator looks at the upfront investment costs expenses and earnings to calculate the ROI.

FHA guidelines in HUD 40001 define rental income as. By analysing property across London weve computed the median rental price for 1 and 2 bedroom flats and compared it to the sales valuations for the same sorts of properties when offered for sale. Tax rates 2021-22 calculator.

Property tax calculator Chennai helps assess property tax. After some time. Rental Property Spreadsheets for analyzing rental deals managing rental properties.

Keep in mind older properties could have higher monthly expenses as more repairs might be required. The capital gains tax rate is 15 if youre married filing jointly with. A mid-quarter convention must be used if the mid-month convention doesnt apply and the total depreciable basis of MACRS property placed in service in the last 3 months of a tax year excluding nonresidential real property residential rental property and property placed in service and disposed of in the same year is more than 40 of the.

Typical loan-related expenses include. Loan origination and loan assumption fees. Enter the total round-trip miles to be driven.

There are a few steps to calculating your rental property gains. Calculating these expenses into the rental property calculator is a necessity for. Rental Property Depreciation deductions limited to new.

The FHA has rules on which it will consider rental income. Making the cash flow calculation is easy especially when using an online rental property calculator like this one. The Investment Property Marketplace on Roofstock is a great resource to use for selling a turnkey rental property and finding other single-family houses and small multi-family properties to invest in.

Calculate the purchase price or basis of your rental property. Super contribution caps 2021 - 2022 - 2023. Tax rates 2022-23 calculator.

Capital improvements repairs to calculate your total cost basis for depreciation. Rates are on a 24 hour basis Enter the market price of one gallon of fuel. Our pet addendum requires that the Resident have the property professionally treated for fleas and the carpet professionally cleaned once they move out.

On a more regular basis you can expect to invest money into repairing plumbing or fixing broken appliances. Most lenders will be able to use the proposed rental income of the property that youre buying. Rental Income refers to income received or to be received from the subject Property or other real estate holdings The guidelines also state that it will consider two types of residential property as rental income.

Enter the daily rental vehicle rate from the State Travel Management Program website. Business Hours Mon - Fri. Unlike your primary residence where you can only deduct qualified points and interest you can deduct all costs associated with obtaining a new mortgage for your rental property.

In these articles or making any investment decision on the basis of such information or any such contents or otherwise. There will also be seasonal expenses such as snow removal. The reason is that when property changes hands as a result of a divorcewhether it is the family home a portfolio of stocks or other assetsthe tax basis of the property also changes hands.

Free rental investment property management spreadsheet for Australia residential property investors. The original basis is your purchase price or 340000 in this case. Theyll either ask for a letter from the real estate agent to confirm the market rent income or theyll use the rental figure estimated by the bank valuer.

In addition as with the ownership of any equity rental properties give the. Lets work through them. Choosing a basis to work out residential property deductions.

Mileage Reimbursement Calculator Instructions. 8 AM to 5 PM Sat - Sun. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

Our London rental yield map is a resource for buy-to-let investors and landlords. Owner-occupied residential structures get a 25 rebate in monthly rental value in Chennai property tax. Original cost basis for a rental property.

Usually the pet deposit is fully refundable. Because the new owner gets the old owners basis he or she is responsible for the tax on all the appreciation before as well as after the transfer. Chennai property tax calculator is for test purposes.

The total monthly operating cost is how much it will take to operate the property on a monthly basis which includes repairs maintenance insurance and more. The Rental Property Calculator can help run the numbers. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange.

In practice rental expenses are often collated on a cash basis. Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. Were going to use a sale of 400000 on a rental property that was purchased for 340000 four years ago.

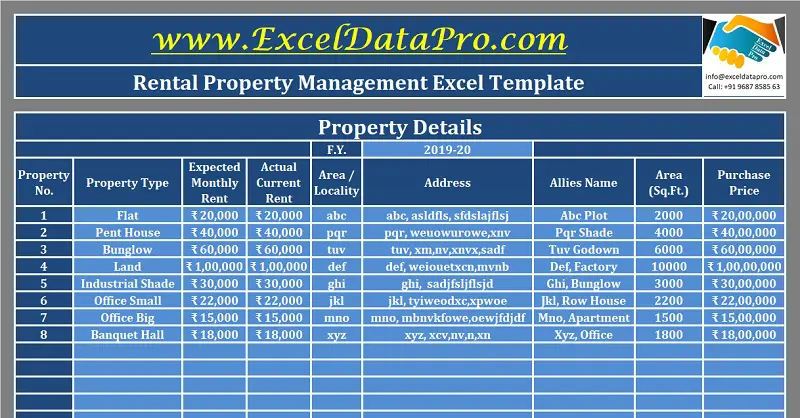

You can track all the income and expenses up to 10 properties on a monthly basis. Web-Based Rental Software Web BRRRR Calculator. Investment Property Calculator does not provide investment.

To get started you should choose a basis to work out your deductions. A rental property can be a profitable real estate investment if you understand the risks involved as well as the potential return on investment ROI. In most cases the bank valuer will have a more conservative figure.

Rental Property and Real Estate Cash Flow Detractors. Increasing the basis of your rental property reduces the amount of taxable. Making the Most of an Inherited Rental Property.

Simply adjust the sliders on the calculator below to customize the financial details. According to the Freddie Mac closing costs calculator estimated closing costs are about 6346. That means the propertys adjusted cost basis is 200000 the purchase price minus the total depreciation taken.

Here are some of the most common ways to adjust the basis of your rental property. The pet addendum and any related deposit or fee is negotiated on a case-by-case basis but usually starts at 350 per animal. The cost of 975 for discount points and 164 for prepaid interest are the only two fees that can be expensed so the remaining closing costs of 5207 must be added to the original cost basis.

Enter the total number of rental days this trip will take. Selling rental properties can earn investors immense profits but may result in significant capital gains tax burdens. Property depreciation for real estate related to.

There are several ways in which rental property investments earn income. The original basis is the price you paid for the investment property plus any improvement.

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

Download Rental Property Management Excel Template Exceldatapro

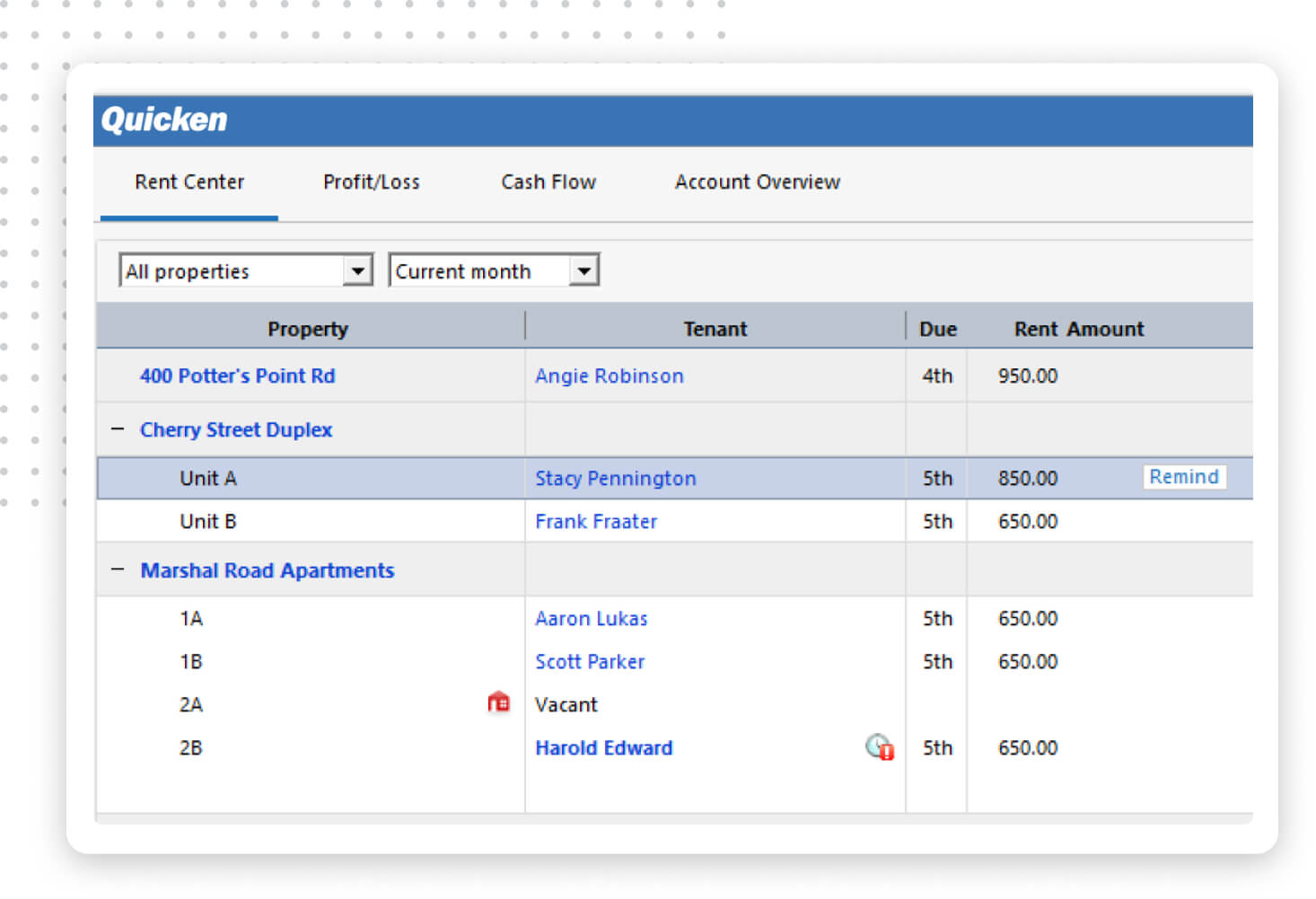

Quicken Rental Property Manager The Easy Way To Manage Your Real Estate

How To Calculate Cost Basis For Rental Property

Rental Property Accounting 101 What Landlords Should Know

How Much Is A Rental Property The Up Front Recurring Costs

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Rental Property Cash Flow Calculator

Rental Property Cash On Cash Return Calculator Invest Four More

How To Calculate Rental Income The Right Way Smartmove

How To Use Rental Property Depreciation To Your Advantage

How To Calculate Depreciation On Rental Property

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

Rental Property Calculator 2022 Casaplorer

A Month To Month Rental Agreement Or Lease Agreement Is A Legally Binding Contract Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

Rental Income And Expense Worksheet Propertymanagement Com